Financial Briefs

Email This Article To A Friend

Is A Market Melt-Up Under Way?

Earnings drive stock prices. Lately, however, earnings have been driving stock prices to record-breaking prices and, with the fourth quarter economic growth rate about to more than double, stock prices could be lifted higher still.

Fourth quarter earnings are likely to surge again, which has economist Ed Yardeni talking about a market melt up.

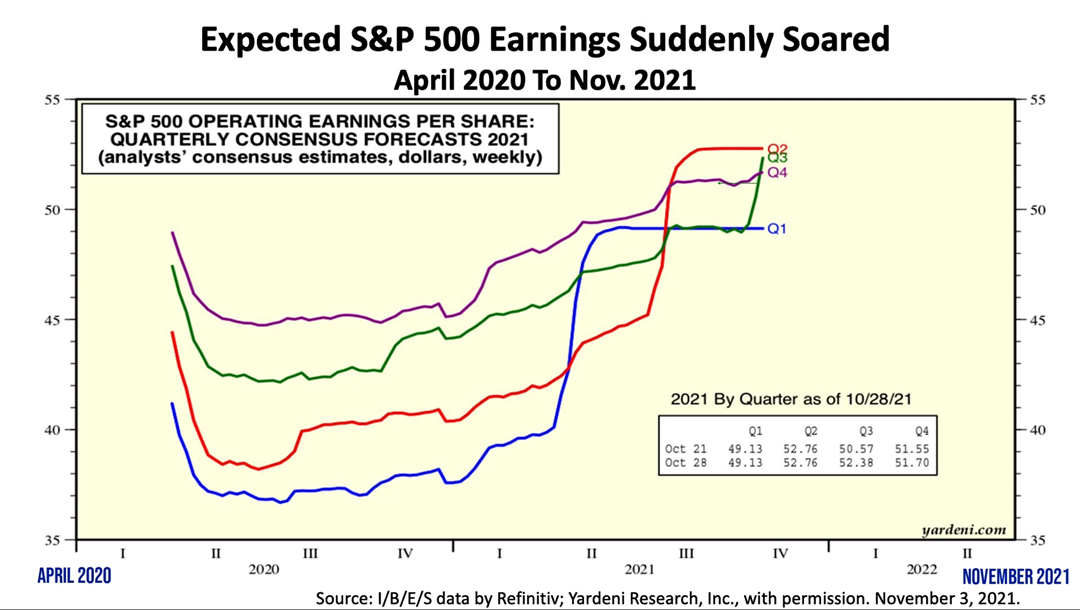

This is a chart from Dr. Ed Yardeni, one of Wall Street’s most widely-followed economists since the early 1980s. Dr. Yardeni calls the four lines “earnings squiggles.” Each squiggle represents the change in earnings projections made by Wall Street analysts for each quarter of 2021, starting in April 2020 through early November 2021. Each squiggle represents the history of earnings forecasts for each of the four quarters of 2021.

The green squiggle shows the surge in earnings expected on the S&P 500 for the third quarter of 2021. When third- quarter earnings reports came in better-than-expected consistently, Wall Street analysts revised their expectations sharply higher. The surge erupted in recent weeks, as companies in the Standard & Poor’s 500 reported their third- quarter earnings to shareholders. Now, more than 80% of the S&P 500 companies have reported their third-quarter earnings, and fourth-quarter earnings will start to be reported shortly. Fourth- quarter earnings are likely to surge again as much or more than in the third quarter, which could ignite a market melt up.

There are two main rules of stock market investing: Rule number one is that earnings growth drives stock prices, and rule number two is that economic growth drives earnings. The rules seemed stacked in favor of rising stock prices.

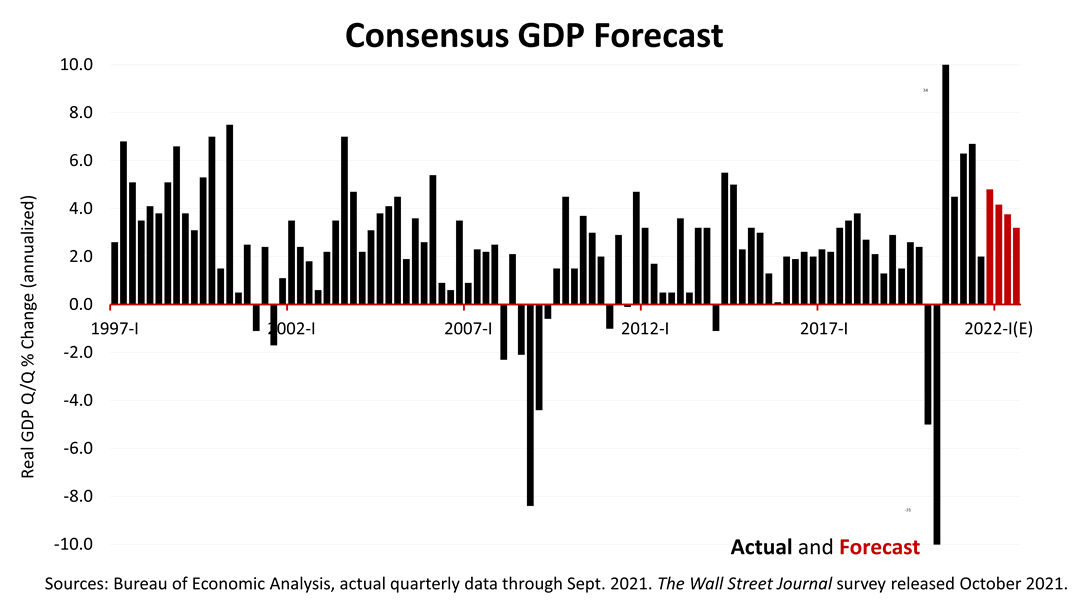

The economy is expected to grow by 4.8% in the fourth quarter. That’s the consensus forecast of the most recent poll by The Wall Street Journal of 60 of the nation’s leading economists. As a result, it’s reasonable to expect earnings growth to surge again in the fourth quarter, when the economy is expected to grow twice as much as in the third quarter, which was hobbled by the Delta-Variant.

Further brightening an already upbeat outlook, the new $1.2 trillion infrastructure law will further boost economic growth in 2022. As the post-pandemic expansion strengthens and the pandemic effects fade, stock prices could surge beyond recent record highs.

This is not a prediction. It is a warning that financial economic facts make a market melt-up a real possibility.

Positioning yourself to benefit from a market melt-up requires knowing your personal financial and tax situation, which enables the kind of comprehensive financial planning advice we can provide to clients.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.